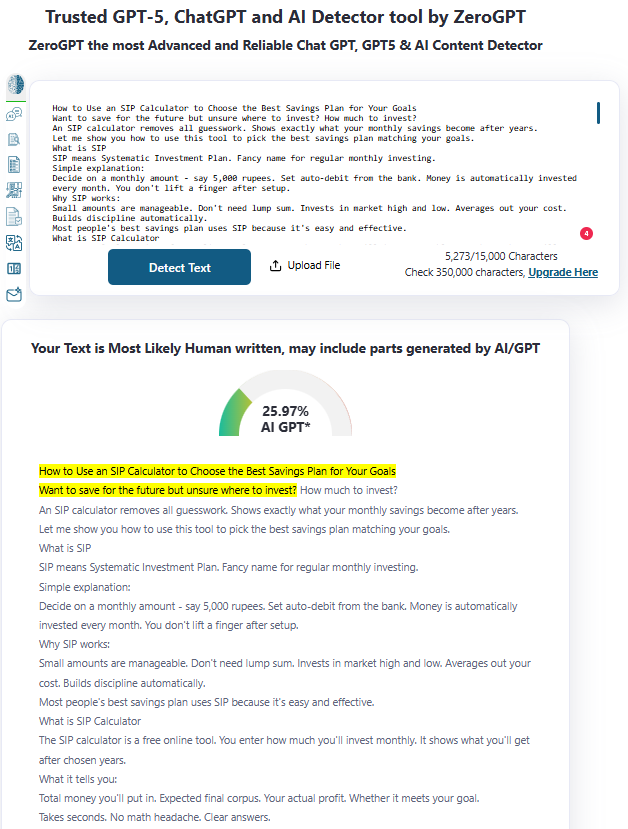

Want to save for the future but unsure where to invest? How much to invest?

An SIP calculator removes all guesswork. Shows exactly what your monthly savings become after years.

Let me show you how to use this tool to pick the best savings plan matching your goals.

What is SIP

SIP means Systematic Investment Plan. Fancy name for regular monthly investing.

Simple explanation:

Decide on a monthly amount – say 5,000 rupees. Set auto-debit from the bank. Money is automatically invested every month. You don’t lift a finger after setup.

Why SIP works:

Small amounts are manageable. Don’t need lump sum. Invests in market high and low. Averages out your cost. Builds discipline automatically.

Most people’s best savings plan uses SIP because it’s easy and effective.

What is SIP Calculator

The SIP calculator is a free online tool. You enter how much you’ll invest monthly. It shows what you’ll get after chosen years.

What it tells you:

Total money you’ll put in. Expected final corpus. Your actual profit. Whether it meets your goal.

Takes seconds. No math headache. Clear answers.

Why You Need a SIP Calculator

Removes guesswork:

“I think 5,000 monthly should be enough.” Really? The calculator shows actual numbers.

Sets realistic goals:

Need 50 lakhs in 10 years? The calculator tells if your monthly amount will reach there.

Compares options:

Try different amounts. Test various time periods. See which savings plan works best.

Motivates you:

Seeing your small investment become big corpus encourages starting now.

Step-by-Step Calculator Usage

Step 1: Know your goal

What are you saving for? Child’s education? House down payment? Retirement?

How much money is needed? 30 lakhs? 50 lakhs? 1 crore?

When do you need it? 5 years? 10 years? 20 years?

A clear goal helps us use the calculator properly.

Step 2: Find a good calculator

Search “SIP calculator” on Google. Many financial websites offer free tools. Pick any reputed site.

Step 3: Enter monthly investment

How much can you invest every month? Be honest about affordability. Don’t put an amount you can’t sustain.

Start with say 5,000 or 10,000. Can always try different amounts later.

Step 4: Choose time period

How many years will you invest? Match this with your goal timeline.

Child’s college in 12 years? Put 12 years. Retirement in 25 years? Put 25 years.

Step 5: Set expected returns

This is crucial. Don’t dream big numbers.

For equity mutual funds: Use 11-12%. For balanced funds: Use 9-10%. For debt funds: Use 7-8%.

Using 15-20% gives wrong expectations. Be realistic.

Step 6: Calculate

Hit the button. SIP calculator shows three numbers:

Total invested (your contribution). Expected maturity value (what you’ll get). Wealth gained (your profit).

If the Calculator Shows a Shortfall

Goal needs 40 lakhs, but the calculator shows only 35 lakhs? Three options:

Option 1: Increase the monthly amount

Try 12,000 instead of 10,000 in the calculator. Check if the gap closes.

Option 2: Extend timeline

Add 2-3 more years if possible. Gives more time to grow.

Option 3: Adjust goal

Maybe 35 lakhs is still good enough? Recalculate the actual need realistically.

Play with the SIP calculator, trying different combinations tillthe numbers work.

Choosing the Best Savings Plan Type

The calculator shows how much you’ll get. But where should you invest that SIP?

For long-term goals (10+ years):

Equity mutual funds. Higher growth potential. Time to ride market ups and downs. Use 11-12% in the calculator.

Best savings plan for retirement, child’s education far away.

For medium-term goals (5-10 years):

Balanced or hybrid funds. Mix of equity and debt. Moderate risk. Use 9-10% in the calculator.

Good savings plan for a house down payment, child’s school fees.

For short-term goals (3-5 years):

Debt mutual funds or conservative hybrid. Lower risk needed. Use 7-8% in the calculator.

Safer savings plan for near-term needs.

Step-Up SIP Strategy

Income increases over the years, right? Your SIP should too.

How it works:

Start with 5,000 monthly today. Increase by 10% every year. Year 2: 5,500. Year 3: 6,050. Year 4: 6,655.

Small increases make a huge difference.

Compare in the calculator:

Fixed 5,000 for 15 years at 12%: Gets 25 lakhs. Starting 5,000, increasing 10% yearly at 12%: Gets 40+ lakhs.

Same starting amount, but final corpus 60% higher!

Some SIP calculators have a step-up option. Use it to see this powerful effect.

Multiple Goals Planning

Most people have several goals. Use the SIP calculator for each separately.

Sample planning:

Child education (12 years away): 8,000 monthly SIP. House down payment (5 years): 15,000 monthly SIP. Retirement (20 years): 10,000 monthly SIP. Emergency fund: 5,000 monthly in a liquid fund.

Total: 38,000 monthly across different savings plans.

Calculate each goal separately. Allocate money accordingly. Track individually.

Taking Action

The SIP calculator shows what’s possible. But a calculator doesn’t invest money. You do. Open a mutual fund account online. Choose funds based on goal timelines. Start SIP with a decided amount. Set it and forget it.

The best savings plan is the one you actually follow. SIP with calculator guidance gives you that plan. Now execute it.