The real estate market constantly evolves, requiring investors to be agile and innovative for sustainable growth. Success depends on diversification, technology, and market trends, while also considering sustainability, consumer expectations, and new asset classes. Understanding these factors helps investors build resilient, growth-oriented portfolios. Let’s explore strategies to guide decision-making and maximize your real estate investments.

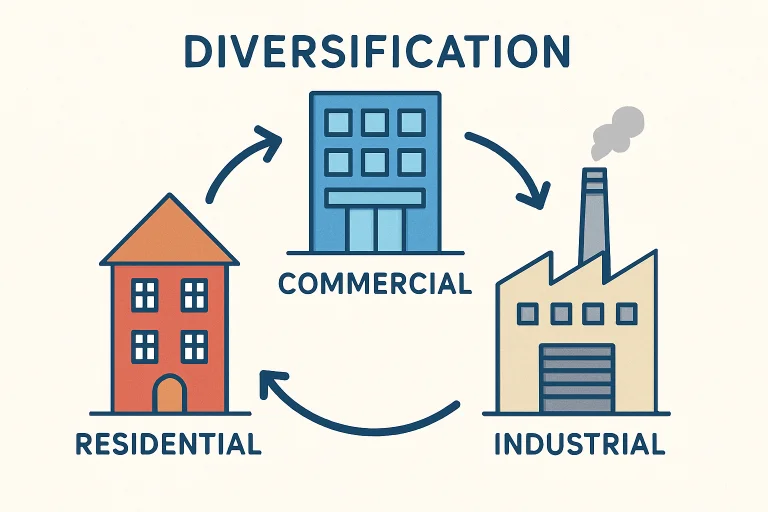

Diversify Investment Portfolios

Diversification is a fundamental principle for mitigating risk and generating robust returns in real estate. Rather than concentrating resources into a single property type or geographical region, investors can distribute capital among residential, commercial, and industrial properties. This balance helps guard against volatility in any one market sector. For example, residential properties often deliver steady cash flow even in economic downturns, while commercial investments may yield higher returns when businesses expand in strong economies. Diversified portfolios consistently outperform single-asset portfolios over long periods, offering investors both stability and growth potential.

Embrace Technology and Automation

Technology has revolutionized property management, tenant relations, and investment analysis. Modern platforms centralize rent collection, maintenance requests, accounting, and tenant communications, reducing the time and effort required for routine tasks. Automation tools such as electronic signature platforms and property showing apps streamline transactions and enhance the tenant experience. Data analytics now play a pivotal role, helping investors forecast market trends, assess performance, and identify new opportunities with precision. Leading firms like Dallas real estate experts The TXRE Group exemplify how tech-driven operations elevate efficiency and transparency in today’s property landscape. According to the National Association of Realtors, in 2024, most real estate professionals rely on digital tools, underscoring the growing importance of technology in modern real estate management.

Focus on Sustainable Development

Environmental awareness and societal expectations are driving demand for sustainable real estate development. Properties built or retrofitted for energy efficiency often attract tenants by offering lower utility costs and improved indoor air quality, promoting better overall wellness. Additionally, governments increasingly offer tax breaks or grants for green building initiatives, making it a financially savvy long-term strategy. Investors who adopt sustainable practices—such as installing solar panels, using eco-friendly materials, or integrating water-saving systems—may see enhanced property values and reduced turnover, as tenants and buyers increasingly prioritize environmental responsibility.

Invest in Property Improvements

Renovations and upgrades are powerful levers for increasing both rental yield and property appreciation. Whether upgrading building systems, adding amenities, or enhancing curb appeal, targeted improvements can make a property stand out in competitive markets. Market surveys indicate that more than half of investors plan significant per-unit improvements in the coming year, recognizing that these enhancements often lead directly to higher rental rates and improved tenant retention. Such investments are particularly important in urban and suburban areas where tenant expectations continually rise and competition for quality housing intensifies.

Explore Alternative Asset Classes

The evolution of industries and population habits has created demand in non-traditional real estate sectors. Data centers, healthcare facilities, logistics hubs, and mixed-use developments each represent asset classes shaped by digital transformation and changing demographics. For example, the ongoing e-commerce boom has sparked heightened demand for warehouse and fulfillment properties, while an aging population is increasing the need for medical office spaces and assisted living facilities. Exploring these asset classes offers portfolio diversity and resilience against economic shifts impacting more conventional real estate sectors.

Leverage Data-Driven Marketing

Data-driven marketing empowers investors to connect with the right buyers and tenants. By utilizing analytics to track client behavior and preferences, investors can develop targeted marketing campaigns that enhance engagement and boost conversion rates. Insights from big data can reveal untapped markets, optimal listing prices, and the best channels for outreach. McKinsey & Company’s research indicates that companies leveraging big data and analytics are twice as likely to be in the top quartile of financial performance within their industries, underscoring the value of data-informed marketing and leasing strategies.

Adapt to Market Demands

Staying attuned to evolving market preferences is critical for long-term success in real estate. The pandemic accelerated the shift to hybrid work, boosting demand for residential spaces with home offices and for flexible commercial environments. Demographic shifts and lifestyle changes are giving rise to new investment opportunities, such as co-living spaces and urban infill developments. Investors should conduct regular market research and reposition properties as needed to capture these trends early, ensuring their assets remain relevant and in demand.

Conclusion

Consistently applying these growth strategies equips real estate investors to thrive amid market complexities and uncertainty. Diversification, technological adoption, sustainability, property improvement, emerging asset classes, data-driven marketing, and responsiveness to demand are all crucial to building strong, adaptive portfolios. By prioritizing these approaches, investors position themselves for both immediate gains and long-term resilience as the market continues to evolve.