Key Highlights

Here’s a quick look at how you can save with a novated lease:

- A novated lease conveniently bundles your new car’s lease payments and all its running costs into a single, regular payment.

- You gain significant tax benefits because the payments are made from your salary before income tax is deducted.

- This structure effectively lowers your taxable income, meaning you pay less income tax over the lease term.

- A novated lease calculator can give you a clear estimate of your savings based on your salary and car choice.

- You can save on GST for the purchase price of your new car and its running costs.

- Choosing an eligible electric vehicle can unlock even more savings due to a fringe benefits tax exemption.

Introduction

Looking for a smarter, more tax-effective way to own a new car? A novated lease could be the solution. This financing option bundles your car and running costs, offering significant tax savings and financial benefits by using your pre-tax salary. Discover how much you can save and how novated leasing works.

Understanding Novated Leases in Australia

Many have been asking, How much tax can I save on a novated lease?

A novated lease in Australia is a three-way agreement between you, your employer, and a car finance company. It lets you pay for a new car and its running costs directly from your salary over a set term, with certain considerations needed at the end of the term.

This arrangement streamlines car ownership by bundling payments and expenses into one payroll deduction. Before exploring tax benefits, it’s important to understand how it works and who is eligible.

What Is a Novated Lease and How Does It Work?

A novated lease is a type of salary packaging where you choose a car, a finance company buys it, and your employer takes over the lease payments. Before entering into this arrangement, you should consider your financial situation. Unlike a traditional car loan, payments are deducted from your pre-tax salary through salary sacrifice.

The income tax savings from a novated lease in Australia depend on your income, the car’s cost, and the lease term, particularly in the context of a novated lease in Australia. Generally, higher incomes and tax rates lead to greater savings.

Who Is Eligible for a Novated Lease?

A novated lease is a popular vehicle financing option in Australia that allows employees to lease a car using pre-tax income, resulting in potential tax savings. The arrangement involves three parties: the employee, the employer, and a finance provider. Under this agreement, the employer makes lease payments on behalf of the employee through salary packaging, effectively reducing the employee’s taxable income as part of broader employee benefits.

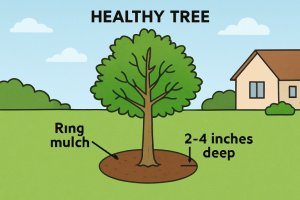

The application process for a novated lease typically starts with selecting a vehicle—either new or used—followed by obtaining quotes from accredited leasing companies or brokers. Once a suitable finance package is chosen, the employer signs a novation agreement with both the employee and the financier. This agreement outlines responsibilities for lease payments, running costs (such as fuel, maintenance, insurance, and registration), and how fringe benefits tax (FBT) is managed, especially at the end of the lease term.

One key advantage of a novated lease is its flexibility. If you change jobs during the lease period, you can usually transfer the agreement to your new employer if they also offer salary packaging. If not, you may need to take over payments directly or refinance the remaining balance at the end of a novated lease.

Tax savings are one of the main attractions of novated leases. By using pre-tax salary to cover both lease repayments and many running costs, employees can lower their assessable income and potentially reduce their overall tax liability. Additional savings may be available if you choose an electric vehicle (EV), as current Australian federal government policies often provide further incentives such as reduced FBT on eligible EVs.

It’s important to carefully consider factors such as your expected annual kilometers driven (as higher usage can influence running costs), your future employment plans, and whether your preferred car qualifies for any special government incentives at the end of your lease. Consulting with both your HR department and an independent financial advisor can help ensure that a novated lease aligns with your financial goals and personal circumstances.

Overall, a novated lease offers convenience and cost-effectiveness for eligible employees while providing access to new or late-model vehicles without large upfront expenses.

How Novated Leasing Can Help You Save on Tax

Novated leasing’s main appeal is its tax benefits. Paying for your car and running costs from your pre-tax salary lowers your taxable income, so you pay less tax and keep more of your earnings each pay cycle. Here’s how salary packaging and pre-tax/post-tax deductions work together to maximize savings.

How Salary Packaging a Novated Lease Lowers Your Income Tax

Salary packaging a novated lease reduces your taxable income because novated lease payments are deducted from your salary before tax. This lowers the income assessed by the ATO, resulting in less tax and more take-home pay compared to a standard car loan. It’s an effective way to fund your vehicle while legally cutting your tax bill.

Pre-Tax and Post-Tax Deductions Explained

A novated lease uses a mix of pre-tax and post-tax deductions to deliver savings. Most car leases, residual value, and running costs are paid from your pre-tax income, lowering your taxable income. A smaller portion is paid from post-tax income to offset potential Fringe Benefits Tax (FBT) liability, as required by the Australian Taxation Office, for cars available for private use. This structure ensures compliance.

- Pre-tax deductions: Cover most car costs and offer primary tax savings.

- Post-tax deductions: Manage FBT liability, avoiding unexpected tax bills.

Novated leases rarely complicate your annual tax return. Tax benefits are handled via payroll, so no special claims for the vehicle are needed.

Estimating Your Potential Tax Savings

Calculating your exact tax savings with a novated lease can seem complex, but it’s easier than you think. Savings depend on your finances, car price, and other factors.

A novated lease calculator provides a personalized estimate, making it simple to see your potential car tax savings.

Using Novated Lease Calculators in Australia

Yes, there are calculators to estimate your potential tax savings on a novated lease. A novated lease calculator gives you a clear overview of possible savings, including the amount of tax you might reduce and the costs.

These online tools are simple—just enter your pre-tax salary, car price, preferred lease term, and estimated annual kilometers. The calculator then estimates tax and GST savings, plus the effect on your take-home pay.

You’ll need: | Variable | Description | |——————|——————————————————–| | Pre-Tax Salary | Your annual income before taxes | | Car Price | Value or purchase price of your chosen vehicle | | Lease Term | Desired length of lease (usually 1–5 years) | | Annual Kilometers| Estimated yearly driving distance for cost calculations|

Example Scenarios Showing Different Levels of Tax Savings

Your potential tax savings depend on your income due to Australia’s marginal tax rates—higher earners pay a greater percentage of their income in tax. Reducing taxable income has a bigger impact if you’re in a higher bracket.

Is a novated lease financially worthwhile for your income? Here’s a comparison for a $40,000 car:

| Annual Salary | Car Price | Estimated Tax Saving (Annual) |

| $70,000 | $40,000 | ~$2,500 |

| $120,000 | $40,000 | ~$4,000 |

Higher earners save more in dollar terms, but significant benefits exist at any salary level. A novated lease can make a new car more affordable by lowering your tax burden—anyone who pays income tax can save.

Common Mistakes When Calculating Tax Savings

While a novated lease offers significant tax benefits, understanding how they’re calculated is key to avoiding common mistakes. Misconceptions can lead to unrealistic savings expectations.

Know the rules on salary packaging, Fringe Benefits Tax (FBT), and GST. Get clear tax advice on car expenses and running costs to make an informed decision.

Misunderstanding Salary Packaging Rules

Common mistakes when calculating tax savings on a novated lease include:

- Assuming all payments are pre-tax, overlooking the required post-tax component to offset FBT.

- Ignoring other financial impacts: Not factoring in how reduced taxable income affects HECS-HELP repayments or government benefits.

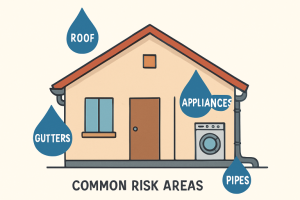

- Miscalculating running costs: Underestimating expenses like fuel, insurance, and maintenance.

To avoid these errors, ensure you understand the breakdown of your lease payments and how they affect your taxable income.

Overlooking Fringe Benefits Tax (FBT) and GST Implications

Mistakes often occur with Fringe Benefits Tax (FBT) and Goods and Services Tax (GST). FBT is a tax on benefits, like the personal use of a luxury car tax threshold. A novated lease typically eliminates FBT liability for your employer through the Employee Contribution Method (ECM), using your post-tax payments.

Key tax points:

- FBT is covered: Your post-tax payments offset FBT, so you don’t face unexpected costs.

- GST savings: You avoid GST on the car’s purchase price and running costs like fuel, servicing, and tires.

- Luxury Car Tax (LCT): LCT applies if your vehicle exceeds the luxury threshold and is included in your lease cost.

Disadvantages? The main concern is proper FBT management, but reputable providers handle this for you.

Conclusion

In summary, knowing how much tax you can save with a novated lease can boost your financial health. By using salary packaging and pre-tax deductions, and understanding eligibility, you can maximize significant savings. Be sure to calculate tax benefits carefully and watch for FBT and GST pitfalls. With the right strategy, a novated lease is a valuable financial tool. For tailored advice, contact our experts for a free consultation.