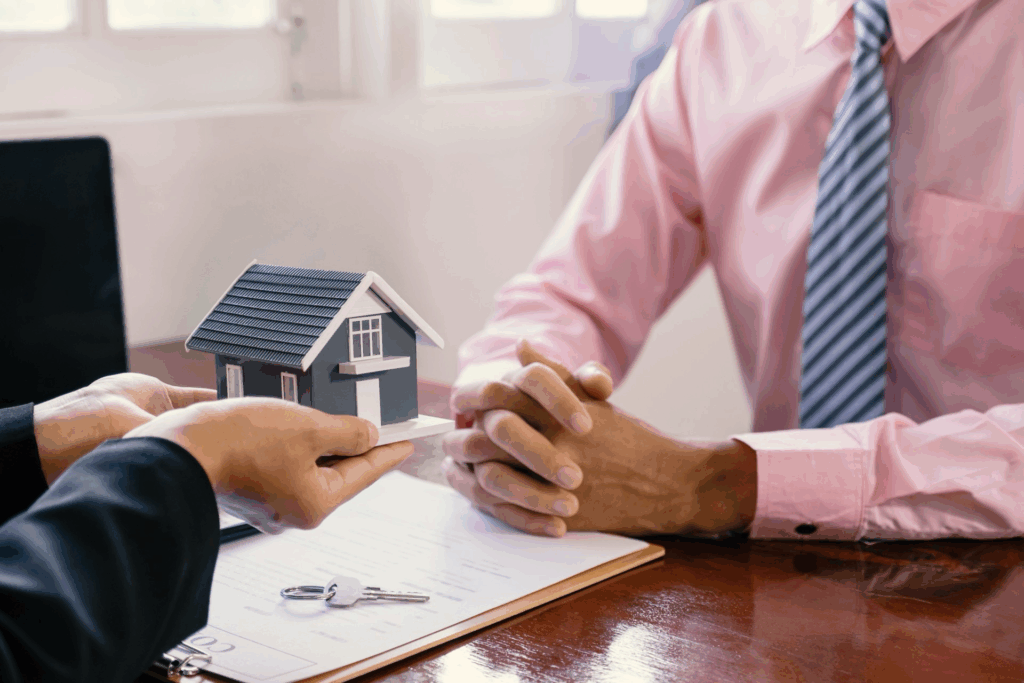

Absolutely, in fact, working with a mortgage broker can be one of the smartest moves a first-time homebuyer can make in San Jose’s competitive real estate market. With sky-high home prices, fluctuating interest rates, and complex loan requirements, buying your first home in the Bay Area can feel overwhelming. That’s where a skilled mortgage broker comes in. Trusted firms like https://marketing.gmccloan.com/mortgage-broker-san-jose-gmcc/ specialize in helping first-time buyers navigate financing options with ease, offering access to flexible loan programs, expert guidance, and personalized service every step of the way.

Here’s how a mortgage broker in San Jose can help first-time buyers succeed:

1. Simplifying a Complex Process

Buying your first home involves a lot of moving parts: mortgage applications, credit evaluations, down payments, closing costs, and more. A mortgage broker simplifies the process by:

- Explaining all your loan options

- Walking you through each step

- Helping you understand unfamiliar terminology

- Providing clear expectations and timelines

This kind of hands-on support is invaluable, especially for buyers who are new to the mortgage world.

2. Access to a Wide Range of Loan Programs

Unlike banks or direct lenders who offer a limited selection of loans, mortgage brokers have access to dozens, sometimes hundreds of loan products from multiple lenders. This includes:

- First-time buyer programs

- Low down payment loans (FHA, 3%-down conventional)

- Down payment assistance options

- VA loans (for veterans and military families)

- Grants or tax credits for eligible buyers

This flexibility helps first-time buyers find a mortgage that fits their budget and qualifications.

3. Personalized Loan Matching

Every buyer’s financial situation is different. A mortgage broker takes the time to assess:

- Your income and job history

- Credit score and debt-to-income ratio

- How much you can afford for a down payment and monthly payments

- Your long-term financial goals

Based on this information, the broker recommends mortgage options that align with your needs and increase your chances of approval.

4. Pre-Approval That Makes You Competitive

In San Jose, where multiple-offer situations are common, having a strong pre-approval letter is essential. A broker can quickly guide you through the pre-approval process and issue documentation that gives you an edge with sellers and agents.

5. Negotiating Better Rates and Terms

Because mortgage brokers work with a network of lenders, they can shop around for the best interest rates and lowest fees something most first-time buyers don’t have the time or experience to do on their own.

Over the life of a mortgage, even a small rate reduction can translate into thousands in savings.

6. Help with Credit or Qualification Challenges

If your credit score isn’t perfect or you have limited income documentation, a broker can connect you with lenders that offer flexible underwriting. They may also offer advice on:

- How to improve your credit score

- How to reduce debt before applying

- What documents to gather to strengthen your application

This proactive guidance is especially helpful for younger buyers or those with non-traditional financial situations.

7. Guidance on Down Payment Assistance and Grants

Many first-time buyers in California may qualify for state or local down payment assistance programs. A knowledgeable broker can help you:

- Identify available programs

- Determine eligibility

- Complete the paperwork correctly

- Coordinate with the right lenders who accept these programs

This can make homeownership more attainable, even in an expensive market like San Jose. Yes, a mortgage broker in San Jose can absolutely work with first-time buyers, and in most cases, they’re one of the best resources you can have on your side. From finding the right loan program to guiding you through your first escrow experience, brokers are here to make the process smoother, smarter, and less stressful.

If you’re looking to take that first step toward homeownership in San Jose, partnering with a mortgage broker gives you access to expert advice, personalized support, and better financing options than you might find on your own. It’s a smart, strategic way to begin your journey into homeownership with confidence.