Key Takeaways:

- Charitable trusts offer a structured approach to philanthropy, providing personal benefits and support to causes you care about.

- Understanding the different types of charitable trusts can help you choose the one that best suits your financial and philanthropic goals.

- Proper planning and professional guidance are essential to maximize the impact of your charitable trust.

Charitable trusts offer individuals a powerful way to give back while maintaining control over how their assets are used. By strategically setting up trusts such as charitable remainder or lead trusts, donors can support causes they care about, receive tax benefits, and potentially provide income to themselves or their heirs. These trusts enable long-term impact, aligning personal values with financial planning. When properly structured, they ensure lasting charitable support while preserving family wealth and legacy. Expert guidance helps tailor each trust to maximize both giving and financial outcomes.

Introduction to Charitable Trusts

Philanthropy is more than just giving; it involves creating a lasting legacy while aligning your financial plans with meaningful causes. One of the most powerful vehicles for this purpose is a charitable trust. By setting up a charity trust, you ensure regular support for your favorite organizations and enjoy significant personal financial advantages. Navigating the various structures available allows you to amplify your impact, maximize giving power, and leave a record of generosity touching generations.

Understanding how to leverage a charitable trust lets you be strategic about your generosity. These trusts combine disciplined planning with real societal benefits, allowing you to support education, health, the environment, and more. In addition to moral satisfaction, charitable trusts can provide notable tax relief and even a stream of income under specific arrangements.

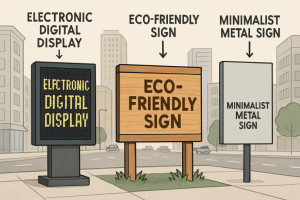

Types of Charitable Trusts

Selecting the right charitable trust is key to matching your goals with the right financial and legal strategy. Common types include:

- Charitable Remainder Trusts (CRTs) allow you or your beneficiaries to receive income for a specified period, after which the remaining assets are transferred to a chosen nonprofit. CRTs are ideal for balancing personal income needs with philanthropic objectives.

- Charitable Lead Trusts (CLTs): Unlike CRTs, a CLT provides income to a charity for a designated period, after which the remaining assets revert to family or other beneficiaries. This can be advantageous for reducing estate and gift taxes while ensuring immediate support for charitable causes.

- Donor-Advised Funds (DAFs): Though not technically trusts, DAFs work similarly donors contribute to a managed fund, receive an immediate tax deduction, and recommend charitable distributions over time. DAFs offer simplicity and flexibility for individuals seeking streamlined giving without ongoing trust administration requirements.

Benefits of Establishing a Charitable Trust

The advantages of putting your charitable intentions into a formal trust arrangement are substantial. Key benefits include:

- Tax Benefits: Charitable trusts often deliver immediate income tax deductions and can minimize or eliminate estate taxes. You may avoid significant capital gains taxes by shifting appreciated assets into a trust.

- Income Stream: CRTs are particularly valuable for donors seeking to maintain lifetime income, whether for themselves or loved ones, while committing significant resources to charity.

- Legacy Creation: These trusts ensure that your values are carried forward; the organizations you select benefit long after you’re gone, forming an enduring legacy of generosity and impact.

Steps to Establish a Charitable Trust

Setting up a charitable trust is a process that involves thoughtful decision-making and collaboration with professionals. Here’s how to get started:

- Define Your Philanthropic Goals: Consider what causes or organizations most resonate with your values. Reflect on the type of impact you’d like to make and the timeline for your giving.

- Choose the Appropriate Trust Type: Each trust vehicle offers distinct features and benefits, so work to match your charitable vision and financial position to the proper structure.

- Consult with Professionals: Engage estate planning lawyers and tax advisors. Their expertise will help navigate legal complexities, tax regulations, and IRS requirements.

- Fund the Trust: Transfer assets such as cash, securities, or real estate into the trust—this initial funding will form the cornerstone of your future philanthropy.

- Manage and Monitor: Trustees should oversee investments and distributions, ensuring alignment with both your charitable intent and any legal obligations.

Real-Life Example: Strategic Charitable Gifting

Consider an individual who donates highly appreciated stock to a Charitable Remainder Trust. By transferring the stock directly, they avoid immediate capital gains taxes, secure an income tax deduction based on the present value of the remainder gift, and receive regular income for years. Once the trust term concludes, the remaining assets benefit their chosen nonprofit, transforming potentially taxable gains into a powerful philanthropic legacy. For a more in-depth exploration, check out the American Heart Association’s comprehensive guide on Strategic Charitable Gifting.

Innovative Approaches to Charitable Giving

While charitable trusts provide foundation and structure, they can be complemented by modern approaches to philanthropy:

- Impact Investing: Allocating capital to companies and funds with measurable environmental or societal benefits and a financial return. This approach lets you pursue profit and purpose together, multiplying your positive influence. Learn more about this strategy in the article Innovative Philanthropy: Beyond Traditional Grantmaking.

- Crowdfunding: Harness the power of the internet to mobilize donations from a broad audience. Online platforms facilitate collaboration, transparency, and engagement on a global scale. Refer to the article Innovative Approaches to Charitable Giving for insights into effective crowdfunding strategies.

- Social Entrepreneurship: Supporting ventures that blend business acumen with mission-driven innovation, creating sustainable solutions to pressing social challenges. This approach is discussed in detail in the article Innovative Approaches to Philanthropy: Emerging Trends and Practices.

These strategies rapidly evolve, expanding how to make a difference alongside traditional philanthropy.

Conclusion

Charitable trusts provide individuals and families with a disciplined, strategic approach to philanthropy, combining personal financial rewards with significant societal benefits. Understanding the options be it a CRT, CLT, or DAF empowers you to create a personalized, flexible giving plan. When built thoughtfully and managed with professional support, a charitable trust can be the cornerstone of an enduring, values-driven legacy.